sales tax office in austin tx

Sales Tax Office in Austin TX. Texas Comptroller of Public Accounts The Texas Comptrollers office is the states chief tax collector accountant revenue estimator and treasurer.

Property Held In Trust Steen Law Austin Texas

Director of Sales and Use Tax.

. What is the sales tax rate in Austin Texas. This is the total of state county and city sales tax rates. Call us at 800-531-5441 ext.

On this website on the forms. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. County Parish Government.

The minimum combined 2022 sales tax rate for Austin Texas is. Name A - Z Sponsored Links. If the first Tuesday of the month is a.

This office strives to provide you the. Hays County Tax Office. See reviews photos directions phone numbers and more for Sales Tax Office locations in Austin TX.

On the West steps of the county courthouse 1000 Guadalupe St Austin TX 78701. Arrive before 10 am. 2020 rates included for use while preparing your income tax deduction.

Please be aware there is NO CHARGE to file a homestead exemption application with the appraisal district. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. At the Travis County Heman Sweatt Courthouse 1000 Guadalupe St Austin TX 78701 to check in and receive your auction number.

Sales Tax Rates in Austin County. Johnson State Office Building 111 East 17th Street Austin Texas 78774 8 am. Learn how to title and register a vehicle in Texas.

005 Austin County. The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special.

3-0925 or email us. If you know what service you need use the main. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County.

Tax Information from the Texas Comptrollers. This rate includes any state county city and local sales taxes. Tax sales are held the first Tuesday of the month at 10 am.

The Texas sales tax. Homestead applications are available. Box 149328 Austin TX 78714-9328 Property tax.

Main Office Texas Comptroller of Public Accounts Lyndon B. The latest sales tax rate for Austin TX. The Austin County Auditors Office has made three full years of Financial.

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25

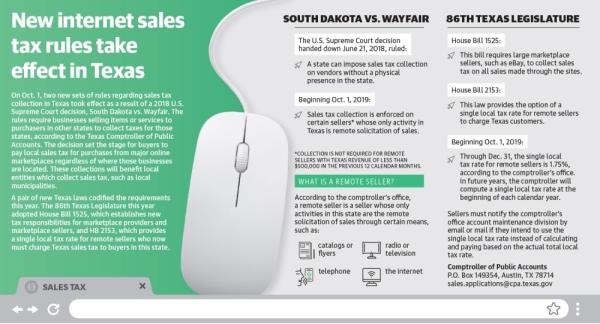

New Internet Sales Tax Rules Take Effect In Texas Community Impact

How To File A Sales Tax Return Electronically As A List Filer Official Youtube

5 Reasons To Purchase Commercial Property In 2018

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What You Need To Know About Texas Sales Tax Holiday This Weekend

Texas Sales Tax Revenues Still On The Decline Reform Austin

Royse City Sees Hefty Boost In Sales Tax Revenue Local News Roysecityheraldbanner Com

Texas Local Sales Taxes Part I

Tax Free Weekend In Texas Back To School Shopping Guide Kxan Austin

Sales Tax Exemptions Texas Film Commission Texas Film Commission Office Of The Texas Governor Greg Abbott

2010 Austin Suicide Attack Wikipedia

Texas Attorney General Opinion Jm 973 The Portal To Texas History

2021 State Business Tax Climate Index Tax Foundation

Travis County Tax Traviscountytax Twitter

Updated Sales Use Tax In Austin Texas In 2022

Notice Of 2021 Tax Year Proposed Tax Rate For City Of Austin Austintexas Gov

Duval County Tax Collector Goes Live With Taxsys Pittsburgh Pa Grant Street Group